How has your experience with the GST (Goods and Services Tax) been?

For me, it has been up and down, and unfortunately more down than up. Most of the items and services I pay for are subjected to GST, and so far it does feel that more money is flowing out of my pockets. Aaarrgghhh!

However, I am very vigilant when it comes to paying, so I will check and recheck before I pay the amount. Here are a few things I look out for:

Check Actual Amount of GST Charged

Please check that the amount of GST charged is accurate. No rounding up to the nearest ringgit please. My accountant source tells me that during GST training by the Malaysian Customs, they were told that merchants are only allowed to round up to the nearest 2 decimal points.

Last Friday when I wanted to pay my son’s ukulele music lesson fees, I was asked to pay an additional RM7 on top of the RM110 fees. I disputed the amount because 6% GST of RM110 is RM6.60, and the shop was rounding up the amount to RM7! The excuse or reason given was that their system automatically rounds it up to the nearest ringgit.

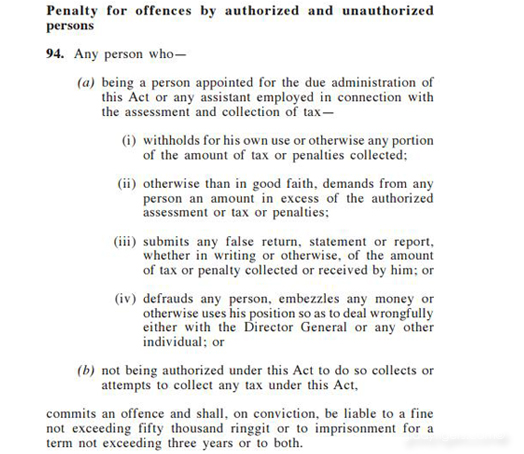

I told them that this should not be the case, and they should have their system recalibrated, or they could be reported to the Customs and be fined RM50,000 or jailed 3 years.

I was promptly refunded my 40 sen. We shall see next month if the system has been changed.

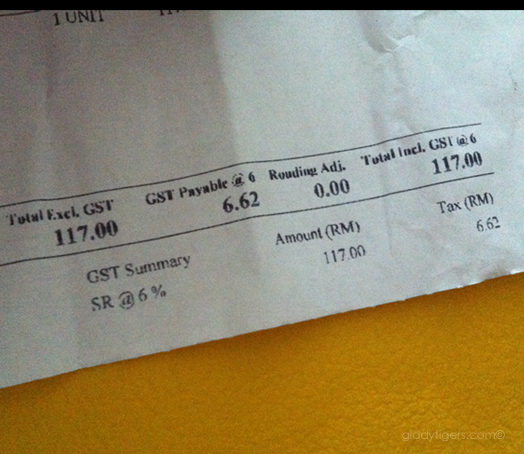

On top of that the receipt issued was a bit fishy too. It states the music fees as RM117, and has GST stated as RM6.62.

According to the GST Act, merchants are not allowed to collect GST in excess of the 6%, otherwise they will be liable to a RM50,000 fine and/or 3-year imprisonment.

Source: GST Act

Source: GST Act

Check Validity of GST Registration Number

Shops that charge you GST MUST provide a receipt with the GST amount clearly stated. Ask for one if you are not given the receipt.

The receipt should state the GST Registration Number or GST ID of the shop or business, and this proves that the establishment has been registered and is approved to collect GST. You should check that the GST Registration Number or GST ID is a valid one and that it corresponds to the shop’s name.

Visit the GST Status Lookup page and key in the GST Registration Number or GST ID or shop’s name to verify.

Check Total Price Against Displayed Price

Here’s something I learnt. The prices displayed are INCLUSIVE of GST. There should not be any additional 6% charged on top of those prices. This is clearly stated in the GST Act.

For example, if a shop sells cakes for RM10.00, and displays the price as RM10.00, they are only allowed to charge you RM10.00, where 6% of RM10.00 (which is 60 sen) is the GST charged. In the receipt, you should see a total charge of RM10.00 with a breakdown of price as RM9.40 and GST as RM0.60.

I’ve already come across a store that is charging 6% on top of the displayed price. I will be getting my facts organised first and I will not hesitate to lodge a dispute if I find the shop still practising this.

By the way, you can lodge disputes on errant merchants with regards to GST implementation by going to the Royal Malaysian Customs Department GST site and lodging an online complaint. I have no idea how long it will take for a resolution to be available though.

No more Government Tax and No more Service Tax

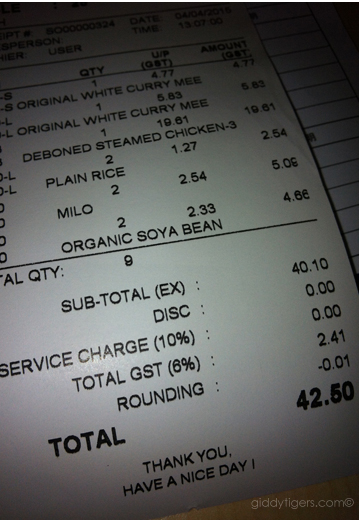

For places where we used to pay both government tax (6%) and service tax (10%) on top of published prices, we now only pay 6% GST, and this GST is already included in published prices! I was so happy to drink my latte from my favorite coffee place with the seemingly discounted rate. 🙂

…and that is just about the only good thing I have experienced with GST thus far.

Little Miracles

Little Miracles Our Journey of Love

Our Journey of Love

Do you know if there’s a 10% service charge, does the 6% GST calculated from the (Total Amount + Service Charge), or just the Total Amount? Example, if total is RM100, service charge RM10, what is the GST amount? Should it be 6% of RM110, or 6% of RM100?

The Giddy Tigress says: The service charge of 10% has been abolished. It has been replaced with GST.

Hmm… then I have to sue this restaurant! It is charging me double service charge 🙁

The Giddy Tigress says: Correction… there are certain restaurants and establishments that still charge service tax. They should display a prominent signage stating that they still do.